On December 21, 2019, Aurora announced that the Company’s Chief Corporate Officer would be stepping down.

Then, on November 29, 2019, Marijuana Business Daily reported that Aurora had violated regulations for the sale of cannabis to German pharmacies. In addition, the Company revealed that it was halting construction on two key production facilities, its Aurora Nordic 2 facility in Denmark and its Aurora Sun facility in Medicine Hat, Alberta.

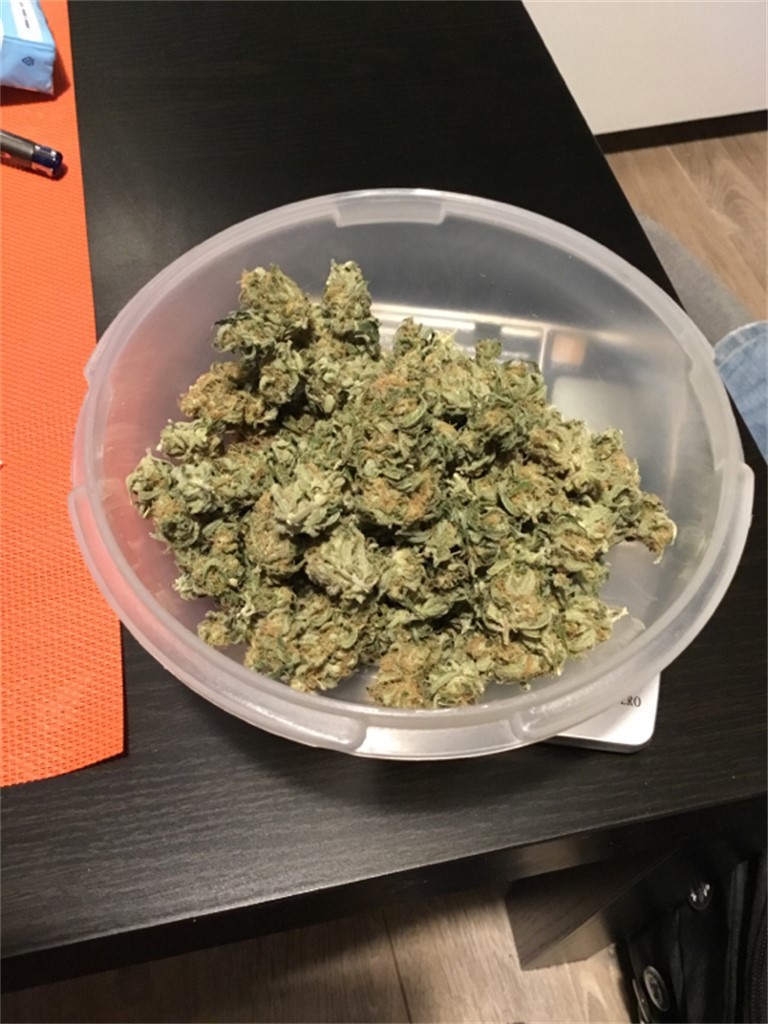

#Aurora cannabis series

The market learned the truth through a series of disclosures beginning on November 14, 2019, when the Company announced disappointing first quarter of fiscal 2020 results, reporting a 25% sequential sales decline and a 33% sequential consumer cannabis revenue decline. As a result of concealing this information from the market, the Company’s securities traded at artificially inflated prices throughout the Class Period. The litigation alleges that Defendants made false and misleading statements and omissions about Aurora’s business, financial performance and prospects. Specifically, Plaintiffs allege that Defendants failed to disclose that they had materially overstated the demand and potential market for Aurora’s consumer cannabis products, that the Company had failed to comply with licensing requirements in the all-important German market, and that the Company was suffering from liquidity constraints and the over-extension of capital commitments, among other misstatements. (“Aurora” or the “Company”) securities between Januto Novem(“Class Period”).Īurora Cannabis Inc., headquartered in Edmonton, Canada, cultivates and sells medicinal and recreational cannabis through a portfolio of brands that include Aurora, CanniMed, MedReleaf, and San Rafael '71. On October 23, 2018, the company began listing its stock on the New York Stock Exchange. In addition, Aurora has a controlling stake in Bevo Farms Limited which was founded in 1986 and operates 63 acres of greenhouse in British Columbia, making it a top supplier of propagated agricultural plants in North America.This is a Consolidated securities class action litigation brought on behalf of investors who purchased or otherwise acquired Aurora Cannabis Inc. The company’s top medical cannabis brands include MedReleaf, CanniMed, Aurora and Whistler Medical Marijuana Co.

Having achieved adjusted EBITDA profitability for the quarter ended December 31, 2022, Aurora says it focused on “profitable growth” in both the global medical and Canadian adult-use markets.Īurora’s adult-use brand portfolio includes Aurora Drift, San Rafael '71, Daily Special, Whistler, Being and Greybeard, as well as CBD brands, Reliva and KG7. As a result, Aurora's balance sheet remains among the strongest in the Canadian cannabis industry.

Investors reacted to the news, sending shares of Aurora Cannabis up 5.6% to $0.70 on the Nasdaq in afternoon trading.Īurora has repurchased $366 million (US$269 million) of its convertible senior notes since December 2021, resulting in annual cash interest savings of roughly $20 million (US$15 million). The purpose of the transaction, which represents a repurchase of a portion of the notes at a 2.5% discount to par value, was to cut Aurora’s debt and annual cash interest costs to reinforce financial discipline. The Edmonton, Alberta-based cannabis company said that after the repurchase, it will have $103 million (US$76 million) of notes outstanding. Aurora Cannabis Inc (TSX:ACB, NASDAQ:ACB) shares jumped after it revealed that it had repurchased C$46.6 million (US$34.3 million) of its convertible senior notes at a total cost including accrued interest of $45.6 million (US$33.6 million) in cash, saving $2.6 million in annualized interest payments.

0 kommentar(er)

0 kommentar(er)